The financial services industry is known for its high-pressure environment, strict regulatory demands, and rapid technological advancements. Employees in this sector face heavy workloads, compliance constraints, and demanding clients—factors that can lead to stress, disengagement, and high turnover rates.

Engaged employees, on the other hand, contribute to better client interactions, increased productivity, and stronger regulatory compliance. Financial institutions that prioritize employee engagement see improvements in retention, performance, and customer satisfaction. A Gallup survey concluded that only 23% of employees are actually engaged at work, indicating significant room for improvement.

:format(png)/f/288714721386412/d2eee051dc/namnl-c3-b6s_design.png)

Employee Engagement in Financial Services

Key Challenges to Employee Engagement in Financial Services

Despite the clear benefits, many financial services organizations struggle with engagement due to:

Low Engagement Levels – High-stress environments and repetitive tasks can lead to disengagement.

Low Response Rates in Engagement Surveys – Employees may feel that their feedback doesn’t lead to real change.

Strict Regulatory and Compliance Requirements – Rigid structures can make it difficult to implement flexible engagement initiatives.

Diverse and Multi-Lingual Workforce – Global financial institutions need solutions that cater to employees in different regions and languages.

High Employee Turnover – Lack of engagement contributes to frequent staff attrition, increasing hiring and training costs.

Low Job Satisfaction – Limited career growth opportunities and work-life balance issues often lead to dissatisfaction.

The Impact of Employee Engagement in Financial Services

Engaging employees in financial services leads to tangible business benefits, including:

Improved Client Trust and Satisfaction – Engaged employees provide better service, fostering long-term client relationships. For example, financial institutions with high employee satisfaction report a 25% increase in client satisfaction.

Reduced Absenteeism – Motivated employees show up consistently and contribute more effectively.

Lower Turnover Rates – Organizations retain top talent by fostering a culture of engagement and support. Effective employee experience design can reduce turnover rates by up to 30%.

Stronger Customer Service Focus – Employees who feel valued are more likely to go the extra mile for clients.

Fewer Errors and Compliance Issues – Engaged employees are more likely to follow procedures and reduce costly mistakes.

Higher Job Satisfaction – A positive workplace culture leads to better morale and teamwork.

Engagement-graph:format(jpeg)/f/288714721386412/f8d13c1d33/engagement.jpg)

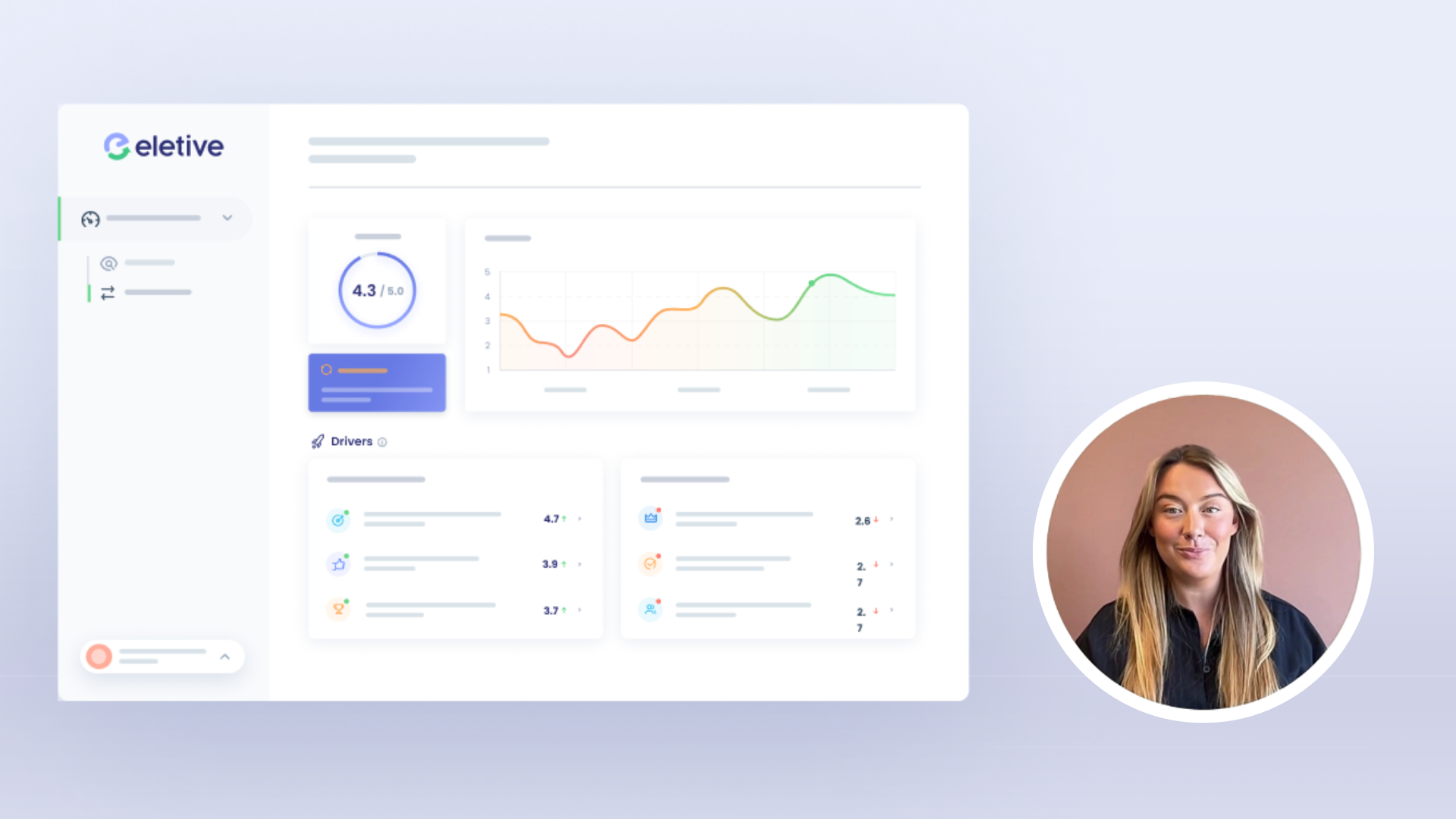

How Eletive Supports Employee Engagement in Financial Services

Eletive helps financial institutions measure and enhance engagement through innovative tools tailored to industry-specific challenges. Key features include:

Real-Time Pulse Surveys

Eletive provides instant insights into employee sentiment, allowing organizations to identify and address issues before they escalate.

Flexible Survey Schedules

Tailor survey frequencies to fit the unique needs of different departments, ensuring relevant and actionable feedback.

Multi-Language Support

With support for over 45 languages, Eletive fosters inclusivity and ensures all employees can participate effectively in engagement initiatives.

AI-Powered Sentiment Analysis

Advanced AI tools analyze free-text responses to uncover trends and key concerns, making it easier to address employee needs at scale.

Customizable Surveys & Question Packages

Organizations can choose pre-made question sets or customize their own surveys, focusing on critical topics like workplace culture, leadership, and career development.

100% Anonymity for Honest Feedback

Eletive ensures complete anonymity in survey responses, encouraging employees to share honest feedback without fear of repercussions.

Seamless HRIS Integration

Integration with existing HR systems streamlines data collection and minimizes administrative work, allowing HR teams to focus on strategic engagement efforts.

Creating a Culture of Continuous Improvement

Engagement isn’t a one-time initiative—it’s an ongoing process. With Eletive, financial services organizations can:

Foster open communication by encouraging regular feedback and dialogue.

Act swiftly on feedback to demonstrate that employee input leads to real change.

Develop self-leadership by providing individual dashboards for employees to track their own engagement levels and personal growth.

Leadership plays a crucial role in fostering a culture of engagement. Trust in leadership is a key driver of employee engagement, and leaders must act with transparency and integrity to build this trust.

Build a Thriving Financial Services Workforce with Eletive

In a sector where trust, performance, and compliance are critical, employee engagement is a key driver of success. By leveraging Eletive’s data-driven insights and AI-powered tools, financial institutions can build a more engaged, motivated, and high-performing workforce.

Want to see how Eletive can help your organization boost engagement? Schedule a demo today and take the first step toward a more engaged workforce.

As Team Manager, Customer Success at Eletive Emelie is helping organisations build workplaces where people thrive. In her role, she enables delight among our customers and leads the Customer Success team to excellence.

:format(jpeg)/f/288714721386412/431bbe3ae0/blog-employee-engagement-in-financial-services-organisations-hero_media.jpg)

:format(jpeg)/f/288714721386412/1280x720/02da360edc/performyard-alternatives.jpg)

:format(jpeg)/f/288714721386412/1280x720/154d0efc4c/tinypulse-alternatives-hero.jpg)

:format(jpeg)/f/288714721386412/1280x720/940c479a26/delighted-alternatives.jpg)